A Jobman person is always cautious about his EPF (i.e. employee provident fund). Employee Provident Fund or Employee Provident Fund (EPF)is mandatory in every company. The EPF is a scheme that gives sum amount and also gives pension benefits when retired. At present, over 4 crore EPF account holders are in epf India. Whose accounts are looked after by the EPFO? Here, we will try to give you full information about the EPF India, which is usually called PF and also tell you how much the amount of EPF's contribution is.

What is EPF?

The EPF is an investment plan which is mandatory for every job paid employee. Employees Provident Fund Organization(EPFO) maintains the contribution of all EPF account holders. EPF is mandatory for all employees of government and non-government. According to the rules, the company employed in more than 20 employees is required to register in the Employee Provident Fund Organization. The contribution that the EPF runs on is only for the employee and only the employee has the right to it.

How much does the EPF Contribution?

EPF Contribution also has rules about EPF contributions. 12 percent of any employee's salary is contributed by the contribution and that is, 12 percent is contributed by the company.

Now 12 percent of the amount that you deduct from your salary goes to the EPF account, while the 12 percent of the company deducts 3.67 percent of the EPF account and the remaining 8.33 percent is EPS i.e. The employee goes to the pension scheme. In total, you get a contribution of 24 percent, out of which a large portion goes to the EPPF and the rest is in the form of a pension.vYou can withdraw the pension amount after the age of 58 years or as a monthly pension.

What is the Difference between EPF and EPS?

Here we must understand the difference between EPF and EPS.

The EPF is the part of your contribution that you can get out of your job during a job or after the job. While the amount of EPS is the employee's pension If the employee has completed 10 years of his job, he can withdraw the amount of his EPF but can not withdraw the pension amount. The amount of pension is received only after the age of 58 years.

The retired person receives this monthly pension(epf). When can you withdraw money from PF if you want to withdraw your PF money, then you have to follow certain conditions. We are telling you about the conditions required to remove PF here.

- If you have left the job and you are unemployed for two months then you can withdraw PF's money.

- If you want to withdraw EPF money during the job, then it is only possible that you have completed 5 years of your job.

- If you want to withdraw EPF money during the job, then it is only possible that you have completed 5 years of your job.

- You can also get a maximum of 90 percent of the amount of EPF.

- You will have to tell the reason for the withdrawal of EPF during the job.

- During the job, you can buy a home and withdraw money from EPF for marriage.

How to get pf bonus for Employees?

Those shareholders of EPF who will continue contributing for 20 years or more, they will receive an additional amount of Rs 50000 (which can be called bonuses) at the time of retirement. After the information was given by a senior official about this, it has been said that the recommendations will be implemented after the government's permission. It will be initially started for two years on an experimental basis and will be reviewed later.

How to get bonus benefits?

The benefit of Rs. 50 thousand will be available under the exception of the account holder for less than 20 years if the shareholder has become a victim of lifelong disability (disability). In fact, the CBT has recommended revising the Insurance Scheme related to employee deposit (EDLI) in its meeting. It has also been recommended that a minimum sum assured of Rs. 2.5 lakhs (fixed amount) should also be provided on the death of the shareholder.

How To UAN Registration To View EPF Balance?

For information about how much epf money is deposited in your provident fund (pf)account i.e., you can get full information by logging in on the EPFO's website, but for that, you must have a UAN or a universal account number. The EPFO started UAN in 2014 so that you can get your account online. Register on the site through this number, check the epf passbook of the account and if you like, then download it too. You can also check how much contribution is done on your behalf.

How to Update your EPF details?

In addition, you can download your UAN card from here, you can also update EPF KYC (Know Your Customer). It is extremely important to use this interface that you have a UAN number. Activate your UAN account and after logging in to the portal, download the EPF passbook or make other necessary updates.

Without a UAN-How to check the EPF balance?

If you do not have UAN, you can also check your EPF but for this, you should know what your EPF account number is. You will get this account number written on your payslip. Go to the site and choose your state and then choose Regional Office. After typing these particulars here, you will receive SMS related to EPF balance.

EPF balance can also be checked by SMS

If you are having trouble finding the online EPF balance, you can also know your EPF via SMS. Through the EPFO SMS service, you also give information about the amount in your provident fund account. SMS to 07738299899. Well, this feature is only for those who have been activated with UAN.How to Check Your EPF Balance? here pf balance Check SMS, Missed Call or EPFO website

How to Send SMS to check epf balance?

Write in the message box when sending an SMS, EPFOHO UAN, write the first three letters of the language in which you want it, for example - by writing EPFOHO UAN ENG, send an SMS to 07738299899 and you will get information in English. Actually, this service is also available in other Indian languages. To SMS from the mobile to SMS, type in the message box and type EPFOHO UAN ENG after sending it to 7738299899. In a short time, your numbers will get all the information related to PF balance.

epf balance can be viewed as different languages

Balance information in other languages will also be available. If you want to receive SMS in any other language, it has also been given to change the language like English-ENG Telugu-TEL Punjabi- PUN Gujarati-GUJ Marathi- MAR Malayalam-MAL Tamil - TAM Kannada - KAN Bengali - BEN

Check your epf balance without the internet, Without sending SMS-How to?

This is the easiest way to know the EPF balance. No SMS, no Internet Bus will have to be deleted from your registered mobile number by the EPFO number and information of your EPF balance you have issued to the EPFO for the information of the balance 01122901406 which you only have to give the miss calls, after which your mobile The information of the EPF balance will be sent on.EPF balance through Miss call Services

Check your epf balance using Login to EPFO UAN Portal-How to?

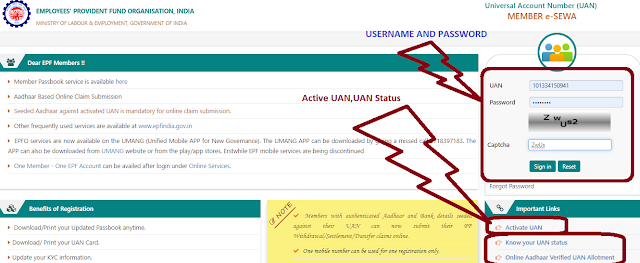

First Process, you will need to https://unifiedportal-mem.epfindia.gov.in/memberinterface/ click this link.

After the link opens, you may be looking at some empty boxes on the right, in which the UAN will be written to enter UAN Number and Password. If you are coming to the UAN portal for the first time, then you have to register to know the PF balance sheet.

Read the Following Process for Register Your UAN Number-Step By Step

Step 1: https://unifiedportal-mem.epfindia.gov.in/memberinterface/ Once the link is opened, the active UAN is written down on the right, which you will have to click.

Step 2: After this, you will get a new window in which you must type your UAN number. Apart from this, you do not have to type Member ID, Aadhar ID or PAN ID, etc. Then you have to type your name, after which you can enter the calendar, then the mobile number and email id. After this whole process, you need to type captcha words. Type captcha words as they are written in the box. Then you will get the authorization code that will be given to the mobile number you provide.

Step 3: The authorization code will arrive on your mobile, it will be OTP, these OTP will already be entered in the box set. You just need to type in the OTP ID in the box below. Your UAN number will activate as soon as you type the correct ID, and after that, a message will appear on your mobile number which will contain the password for your UAN number.

The second Process, Now you have to go to the UAN number home page once again where you need to enter the UAN number of 10 digits in the UAN number box in the box that appears on the right. Then you have to type the password. Type the password that was already sent via SMS to your mobile number. Type the same password as small letters in small and in capital letters capital. Then login by typing the cache word.

The third Process, Change your password first, after epf employer login. Because the given password is very complex which is not easy to remember. After logging in, you will be given the option of account settings on the left of the page which will open in front of you, you can change your password.

Forth Process, After changing the password, you will need to log in again, after epf employer login, you can download the UAN card, besides going to the view, you can see the passbook.

You will have to click on https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp to see the epf passbook. Let us know that you will not be able to see epf passbook immediately after epf registration, it will take 4 days. So you check epf passbook after a few days.

|

| EPF India ~ epf online,epf balance,epf passbook,epf claim status,epf kyc update |

How to Update epfo kyc?

To update UAN KYC, you must first epf employer login to the UAN portal. If you have not yet activated the account on the UAN portal, then do this work immediately. After logging in, you will see all the options on the left side of the UAN portal. In which the option of epfohome, view, manage, account and online service are visible. Now you have to click on the option of the management.

After clicking on the option of EPF KYC, you will get a place to fill the details of all the services related to the bank, PAN, basis in front of you. If you have to fill out the bank details, select the bank first and fill out the bank account number then type your name in the bank. After this, type the bank's IFSC code. After filling the details, click on Save. Let us tell you here that the details you have given will be approved by the concerned department and your employer.

How to get UAN through the portal?

if you can forget your UAN Number Then epf members who want to get UAN online, click on the UAN portal https://iwu.epfindia.gov.in/eKYC/. After accessing this Portal, you will have to click on the Member Portal and select "Select your UAN", which generates the UAN. To generate a UAN on the Member Portal, UAN, Mobile, and Member Number is required.

I have changed my job. Should I get a new UAN?

No, The same UAN will continue on the job change. If you change your job then you have to do the first thing that you should tell your next employer your UAN. That means the company that you are going to join will have to tell your UAN number.

What are the main Advantages of Investment in the EPF?

There are all the benefits of investing in the EPF, which you are telling you about.

- The money deposited in the EPF is tax-free under Section 80C of Income Tax.

- if you deposit the contribution in the EPF for 5 consecutive years, the tax does not seem to be used to withdraw money from the fund.

- Tax will be charged for withdrawing money before 5 years.

- If you want to withdraw money from the fund during the job, then it will be filled in Form No. 19(epf withdrawal form 31). pf withdrawal form 15g

- if you are going to buy a house to build a house and you are thinking of taking out the money from the EPF, you can withdraw the amount equal to 24 months' salary (basic pay and dearness allowance).

- To buy the flat, the amount of 36 months' salary (basic salary and dearness allowance) will be deducted.

- If you want money for expansion or maintenance in the house, then one year's basic salary can be deducted from the equivalent of dearness and allowance, provided that you have lived in that house for 5 years.

- If you want to withdraw money from the EPF to pay the loan, you will get the equivalent amount of 36-month basic salary dearness allowance.

- Epf Money can be withdrawn for medical treatment. If there is more than one month in the hospital or any major surgery, cancer, TV, paralysis, and heart disease, then money can be given for a salary of 6 months if money is needed. It will have to fill epf form 31(epf withdrawal form 31).

- You can withdraw 50 percent of your contribution to the marriage of your marriage, sister's marriage, son-daughter marriage.

- If you are interested in increasing the amount of contribution, inform the PF office through the employer.

- if you have not nominated anybody then all epf member of the family will get an equal amount. However, you can change your status whenever you want.

Need Compalsury Document for EPF

Employee Provident Fund(EPF), which is the basis for EPF, has extended the date of submission of Aadhaar number to its nearly 4 crore subscribers, on April 30, 2017. Earlier, the EPFO had fixed the deadline to submit the Aadhaar number as on March 31, 2017.

FAQs

There are following epf faq for employers.

FAQs

There are following epf faq for employers.

I have withdrawn a part of my EPF Balance. Will I continue getting epf balance interest on the withdrawn amount as well?

No, you will not get any interest in the epf withdrawn amount. However, the epf amount remaining in the EPF account will continue earning interest.

How to assigned My UAN Number?

When you join a company having more than 20 employees, you become entitled to EPF benefits. EPFO allows a unique 12-digit permanent number known as Universal Account Number (UAN) to the epf member. All PF accounts of an epf member are linked with his UAN. In case you want to avail of online services through the EPF portal, you have to link your UAN with Aadhaar and PAN.

Will I have to activate my UAN for transferring PF online?

You have to activate UAN by registering at the EPF member portal before you can process claims or epf withdraw funds online official epfo portal. You can do it easily by visiting the EPF member portal as active as your UAN as soon as possible.

Click here to complete the form with your order-related question(s).

Click here to complete the form with your order-related question(s).

if I have Changed my job then Should I get a new UAN?

No, the UAN allotted to an epf member remains the same throughout the service period. A new PF account will be opened by the new employer which will be linked to the UAN of the epf member.

I have to leave my company. Should I withdraw EPF balance or transfer my fund?

It is recommended that you transfer your fund from the old EPF account to a new essay. If you withdraw the epf amount before five (5) years of service, then your pf withdrawn amount is taxable and should be mentioned under income from other sources while filing ITR form 16 Compulsory.

I am now unemployed and need funds. Can I withdraw my EPF Balance?

Yes, you can withdraw 75% of your EPF balance after one month of unemployment. In case you remain unemployed for 2 consecutive months, you can withdraw the remaining 25% of the epf fund.

Is it still mandatory for members to link Aadhaar with EPF Account to avail of online services? If not, is there a way to delink Aadhaar with UAN?

As per the recent circular released by the EPFO Home, UIADI has clarified that EPFO can continue to avail Aadhaar based authentication services(epf kyc) for EPF schemes. So, in a way, you can not avail your EPF online services in case you delink your Aadhaar with UAN, as for now.

Is it still mandatory for members to link Aadhaar with EPF Account to avail of online services? If not, is there a way to delink Aadhaar with UAN?

As per the recent circular released by the EPFO Home, UIADI has clarified that EPFO can continue to avail Aadhaar based authentication services(epf kyc) for EPF schemes. So, in a way, you can not avail your EPF online services in case you delink your Aadhaar with UAN, as for now.

The epfo circular also goes on to say that if an epf member visits the EPFO office for an offline claim using Aadhaar KYC, the member will facilitate the Aadhaar kyc facility on the spot in order to make the EPF claim online.

Further, employees with their Aadhaar linked with the UAN may not be allowed to raise offline claims from now on.

Are both the employee’s and employer’s contributions to my EPF account tax-amount?

Both Contributions made to the EPF are tax-exempt, however, the tax calculations are different. The employer’s contribution pf to the EPF account is not considered as part of your taxable income. So the employer’s contribution is tax-exempt at its source.

epf claim status shows payment under process What to do?

When epf claim status displaying "epf claim status shows payment under process", you can be waiting up to One or Two weeks after then don't wait you can contact to your organization or company.

Whereas, the employee’s contribution is counted as part of his/her taxable income. However, the employee’s contribution is tax-deductible under section 80C up to a maximum of Rs. 1.5 lakh per annum. So an employee’s contribution towards the EPF account is eligible for tax-exemption but only under section 80C.

Whereas, the employee’s contribution is counted as part of his/her taxable income. However, the employee’s contribution is tax-deductible under section 80C up to a maximum of Rs. 1.5 lakh per annum. So an employee’s contribution towards the EPF account is eligible for tax-exemption but only under section 80C.

Also, in case the epf member withdraws your EPF fund before 5(five) years of contributions, then both employees, as well as employer’s share, become taxable.

So here in this way we have tried to give you a piece of detailed information about the EPF India. The EPF is an investment plan, as well as a plan to give benefits of pension and tax rebate. We will also keep you informed on the following changes in the EPF. How do you know this information in the comments box? More EPF India

Key focus:

epf,epf member,epf claim status,epf online,epfindia,epf payment,epf complaint,epf interest rate,epf India login,epf India member login,epf India uan login,epf interest rate 2019,how to pay epf online,epf balance check on mobile number,epfo member login portal,epf withdrawal,epfo online claim,how to withdraw pf online with uan, epf balance check on mobile,epf withdrawal status online, online epf withdrawal India,epf withdrawal rules 2019,epf claim status shows payment under process, epf claim status under process means, epf claim status contact number, epf interest calculator,epf india customer care number,epfo member login password reset

EmoticonEmoticon